Real-Time vs. Card Payments

As digital payments evolve, two primary mechanisms have emerged: real-time account-to-account (A2A) payments and card scheme payments 💳. While both enable seamless transactions, they differ significantly in infrastructure, security, and processing speed. This page provides a technical comparison of these two payment types, highlighting their distinct characteristics.

| Feature | Real-Time A2A Payments | Card Scheme Payments |

|---|---|---|

| Processing Infrastructure | Uses a direct bank-to-bank network without intermediaries, processed via real-time clearing and settlement. | Relies on a card network (e.g., Visa, Mastercard) with multiple intermediaries, including acquirers and issuers. |

| Settlement Mechanism | Utilises Real-Time Gross Settlement (RTGS), settling each transaction individually in real time. | Batch processing for settlement; transactions settle at the end of the business day or in batches. |

| Transaction Speed | ⚡ Instantaneous – funds are transferred and available within seconds. | Authorised instantly, but final settlement can take 1–3 days. |

| Data Format and Standard | Often uses ISO 20022 messaging, known for compatibility and data richness across financial institutions. | Typically uses ISO 8583 standard, which may limit data handling flexibility. |

| Identification and Routing | Relies on alias-based addressing (e.g., mobile number, email), simplifying the process for users. | Based on card numbers (Primary Account Number or PAN) for routing. |

| Security and Authentication | End-to-end encryption, multi-factor authentication (MFA), and tokenisation; real-time fraud detection algorithms. | Uses encryption, tokenisation, and 3D Secure (3DS) for online security. |

| Availability | 24/7 availability, even on weekends and public holidays. | May be impacted by bank processing hours and batch delays. |

| Chargebacks | Low or no chargebacks since payments are direct and final. | Supports chargebacks for disputes, adding operational costs for merchants. |

| Cross-Border Compatibility | Growing interoperability, especially in regions with established real-time systems (e.g., SEPA in Europe). | Widely accepted internationally via global card networks. |

In-Depth Technical Comparison

1. Processing Infrastructure and Settlement

Real-time A2A payments operate on a direct, bank-to-bank network, which eliminates intermediaries, allowing for ⚡ instant clearing and settlement. For example, Australia’s New Payments Platform (NPP) processes payments immediately, ensuring instant fund availability.

"Real-time payments empower businesses with immediate access to funds, transforming cash flow and customer satisfaction."

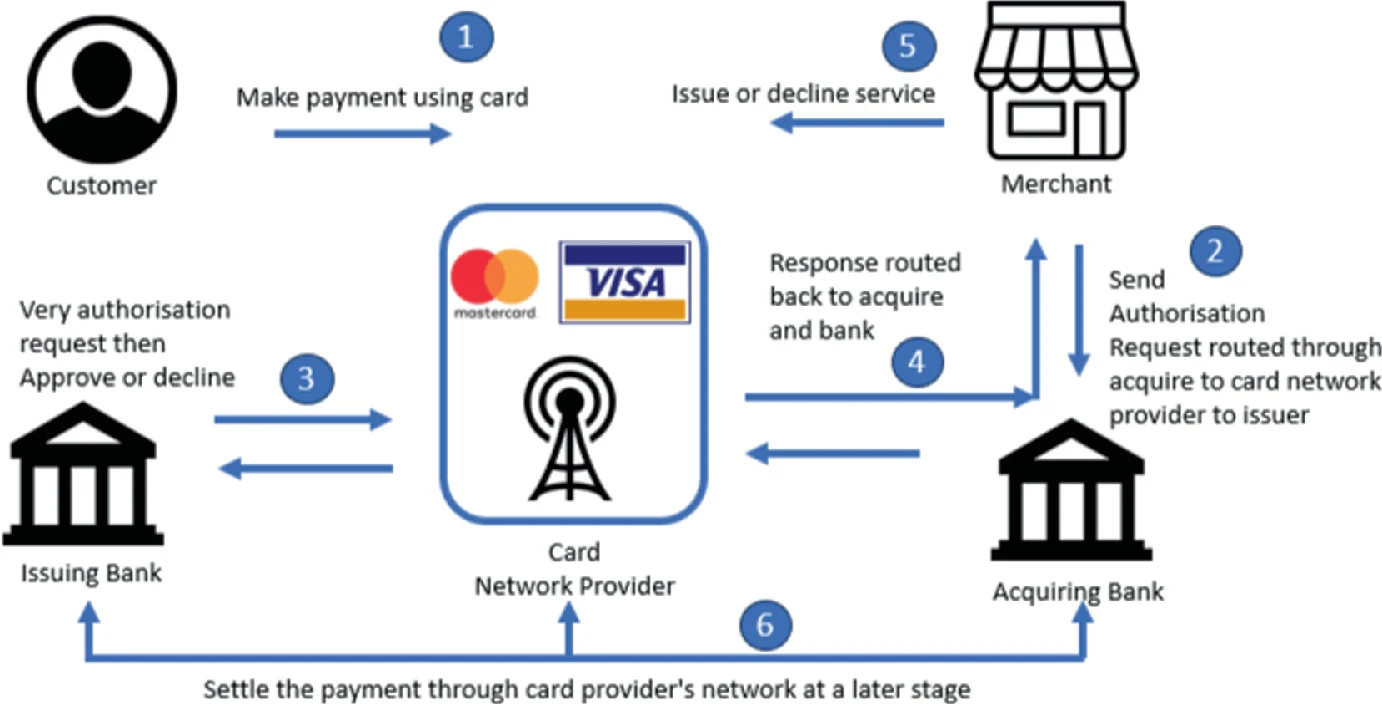

By contrast, card scheme payments involve intermediaries, including acquirers, issuers, and card networks (e.g., Visa, Mastercard). Although authorisations are processed in real time, final settlement completes in batches at the end of the day, often taking 1–3 days.

An illustration of the card payment flow from Springer.

2. Data Format and Standards

A2A payments generally use ISO 20022 messaging, known for its rich data structure and cross-border compatibility. ISO 20022 is the standard for Australia’s NPP, allowing enhanced data fields and interoperability.

In comparison, card scheme payments primarily rely on ISO 8583. While effective for transactional messaging, ISO 8583 has limited data fields, potentially restricting information sharing in cross-border transactions.

ISO 20022 messaging supports detailed information in real-time A2A payments, making reconciliation and reporting easier for businesses.

3. Identification and Routing

Real-time A2A systems simplify payments through alias-based addressing, where users link their bank accounts to identifiers like mobile numbers, emails, or unique IDs. This reduces input errors and improves the user experience.

Conversely, card scheme payments are based on Primary Account Numbers (PANs), where each card links to a specific account number. Although this enables consistent routing, it lacks the simplicity of alias-based addressing.

4. Security and Authentication

Both A2A and card payments employ high-level security, but their approaches differ. Real-time A2A systems use end-to-end encryption and multi-factor authentication (MFA), supported by real-time fraud detection. This proactive security is crucial given the finality of A2A transactions.

Card scheme payments use encryption, tokenisation, and 3D Secure (3DS) for online security, requiring additional user verification. While this enhances security, it can introduce friction in the payment process.

5. Chargebacks and Dispute Resolution

Real-time A2A payments generally have low or no chargebacks since transactions are final and irreversible once processed. This benefits merchants by reducing dispute-related costs, though it limits recourse in cases of fraud.

In contrast, card scheme payments allow chargebacks where customers can dispute transactions. Although this offers flexibility, it adds costs for merchants due to processing fees and fraud risks.

With card schemes, chargebacks can add operational costs and fraud risk. Real-time A2A payments provide an alternative with lower risk of disputes.

6. Cross-Border Compatibility

Real-time A2A payments are increasingly compatible across borders, particularly within regions with established real-time networks (such as SEPA in Europe). Many networks work toward cross-border interoperability using ISO 20022.

Card scheme payments benefit from global acceptance via card networks, making them ideal for international retail and travel transactions. However, they may incur higher fees for currency conversion and cross-border processing.

Cost Comparison

| Cost Aspect | Real-Time A2A Payments | Card Scheme Payments |

|---|---|---|

| Transaction Fees | Generally lower; direct bank-to-bank transfers avoid card network fees, reducing costs for merchants. | Higher due to fees from multiple parties, including interchange, acquirer, and network fees. |

| Intermediary Fees | Minimal intermediary fees due to the direct bank network. | Higher due to involvement of acquirers, issuers, and card networks. |

| Merchant Discount Rate (MDR) | Typically lower than card schemes, as MDRs exclude card network fees. | Higher, as MDRs include network fees, assessments, and processing costs. |

| Cross-Border Fees | Limited cross-border costs, especially within regional real-time networks (e.g., SEPA). | Higher cross-border fees, including foreign transaction and conversion charges. |

| Chargeback Costs | Low to none; A2A systems generally lack chargebacks, reducing dispute costs. | Significant, as chargeback processing adds operational costs for merchants. |

Key Takeaways

-

Transaction and Intermediary Fees: Real-time A2A payments offer lower fees due to fewer intermediaries, benefiting merchants with reduced operational costs. Card payments involve multiple intermediaries, increasing transaction costs.

-

Merchant Discount Rate (MDR): A2A payments usually have lower MDRs because they bypass card network fees, making them cost-effective for high-volume merchants. Card schemes have higher MDRs, especially for high-volume businesses.

-

Cross-Border Transactions: For cross-border payments, A2A networks within regions (such as SEPA) offer cost-effective solutions. Card scheme payments can incur significant cross-border fees, impacting overall costs.

-

Chargebacks: A2A payments minimise chargeback costs, as transactions are final. Card schemes, however, support chargebacks, adding dispute processing costs and potential financial risk for merchants.

Real-time A2A payments offer a cost-effective alternative, reducing fees from intermediaries, cross-border transactions, and chargebacks. Card payments, while globally accepted, involve layered fees from card networks.