PayTo Agreement Specification

PayTo is a transformative solution under Australia’s New Payments Platform (NPP), designed for digital, recurring, and one-off payments. A PayTo agreement (also known as a mandate) is a digital authorisation that enables consumers to approve payments directly from their bank account, giving them enhanced control while offering merchants real-time processing and simplified payment management.

Key Fields in a PayTo Agreement

| Field | Description | For Merchants | For Consumers |

|---|---|---|---|

| Agreement ID | A unique identifier generated for each PayTo agreement, making tracking and management straightforward. | Simplifies management and reconciliation by uniquely identifying each agreement. | Provides a clear reference for easy review and management in the banking app. |

| Customer Details | Includes the full name and optional contact information of the customer, ensuring accurate linkage. | Ensures payments are correctly matched to the intended customer. | Confirms that payments are authorised under their specific account, adding legitimacy. |

| Payer’s Bank Account | Specifies the account or PayID from which payments will be debited, providing choice and security. | Verifies payment source details, ensuring smooth processing. | Allows control over the account or PayID from which payments are made. |

| Payee (Merchant) Info | Displays the merchant's name and contact information, increasing transparency for consumers. | Builds trust by displaying clear business identity in transactions. | Provides assurance of where the payment is going, boosting confidence in each transaction. |

| Payment Frequency | Details the interval at which payments will be made, such as weekly or monthly. | Enables predictable revenue planning with structured billing cycles. | Helps consumers understand their payment schedule, supporting better budgeting. |

| Start Date and End Date | Specifies the agreement's duration, allowing for flexible billing terms and time-bound agreements. | Defines payment periods clearly, ideal for subscriptions or temporary services. | Provides clarity on the duration, helping manage financial commitments. |

| Payment Amount | Sets a specific or maximum amount for each payment, depending on the agreement's nature. | Supports consistent cash flow by defining a fixed or capped payment amount. | Offers transparency about costs, allowing consumers to make informed decisions. |

Setup Process of a PayTo Agreement

Setting up a PayTo agreement is secure, straightforward, and involves active participation from both the consumer and the merchant. Here’s how it works:

Step 1: Agreement Initiation

The merchant initiates a PayTo agreement request during online sign-up, checkout, or subscription setup. Essential details—like Payment Frequency, Amount, and Start Date—are entered, and the request is sent to the consumer’s bank for review.

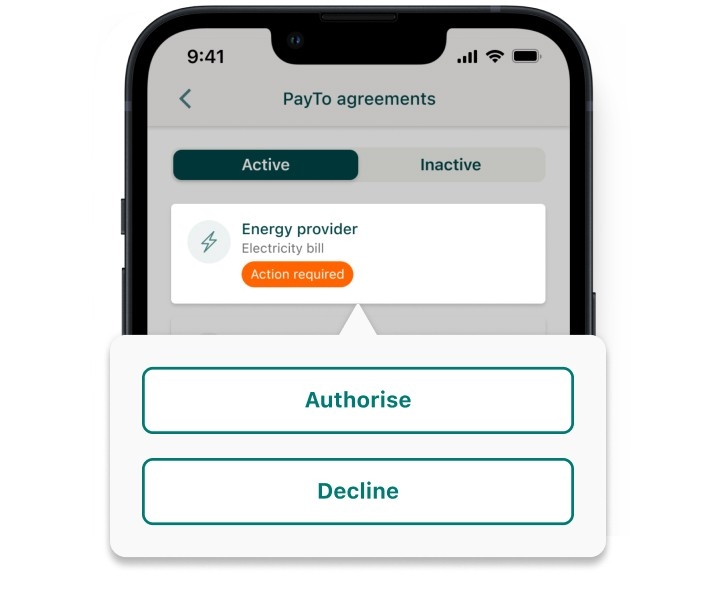

Step 2: Consumer Review and Authorisation

The consumer receives a prompt in their mobile or online banking app to review and authorise the agreement. They carefully check the merchant’s information, payment schedule, and amount to ensure it meets their expectations before approving.

Step 3: Real-Time Confirmation

Once the agreement is authorised, the consumer’s bank notifies the merchant instantly, confirming that the PayTo setup is successful. Payments can now be initiated per the agreed terms, ready for immediate or scheduled processing.

Step 4: Agreement Activation and Payment Scheduling

The merchant can now initiate payments based on the agreement schedule. One-off payments can begin immediately, while recurring payments proceed on a pre-determined cycle until the end date or cancellation.

Both parties receive real-time notifications for each transaction, promoting transparency and keeping everyone informed about the status of each payment.

Why These Fields Matter

These core fields are integral to the PayTo experience:

-

For Merchants: They simplify payments with structured customer, payment, and scheduling data. Real-time processing enhances cash flow, and fields like Agreement ID aid in tracking and reconciliation. Clear payment information builds customer trust and leads to a more streamlined experience.

-

For Consumers: PayTo agreements empower consumers with detailed visibility and control over their payments. They know exactly who they’re paying, when, and how much, fostering confidence. Real-time processing and instant confirmation mean no delays or uncertainties, improving the overall user experience.