Real-Time A2A Payments in Depth

Real-time account-to-account (A2A) payment systems are transforming global payments by enabling direct, ⚡ instant transfers between bank accounts. Australia leads the way with a sophisticated real-time A2A infrastructure that sets a benchmark in terms of speed, security, and convenience. This page explores the technical architecture of real-time A2A payment systems, focusing on Australia’s New Payments Platform (NPP) with perspectives from other systems in India and Southeast Asia, showcasing regional adaptations.

Core Technical Components of Real-Time A2A Payment Systems

Real-time A2A systems consist of multiple interconnected layers and components. Each layer—from clearing and settlement to APIs and security protocols—ensures seamless, fast, and secure transactions.

1. Real-Time Clearing and Settlement Architecture ⚡

A robust clearing and settlement layer is the foundation of any real-time payment system. This layer is responsible for processing and finalising transactions instantaneously.

-

Clearing: Clearing verifies the transaction details, confirms account balances, and authenticates both the sender and receiver. In real-time A2A systems, this happens in milliseconds, allowing for immediate fund transfers.

-

Real-Time Gross Settlement (RTGS): Most real-time systems, including Australia’s NPP, use an RTGS model, where each transaction is settled individually in real time rather than in batches.

Role of Central Clearinghouses: In Australia, the New Payments Platform (NPP) acts as a centralised clearinghouse, coordinating real-time settlements between participating banks, maintaining liquidity reserves, and overseeing transaction finality.

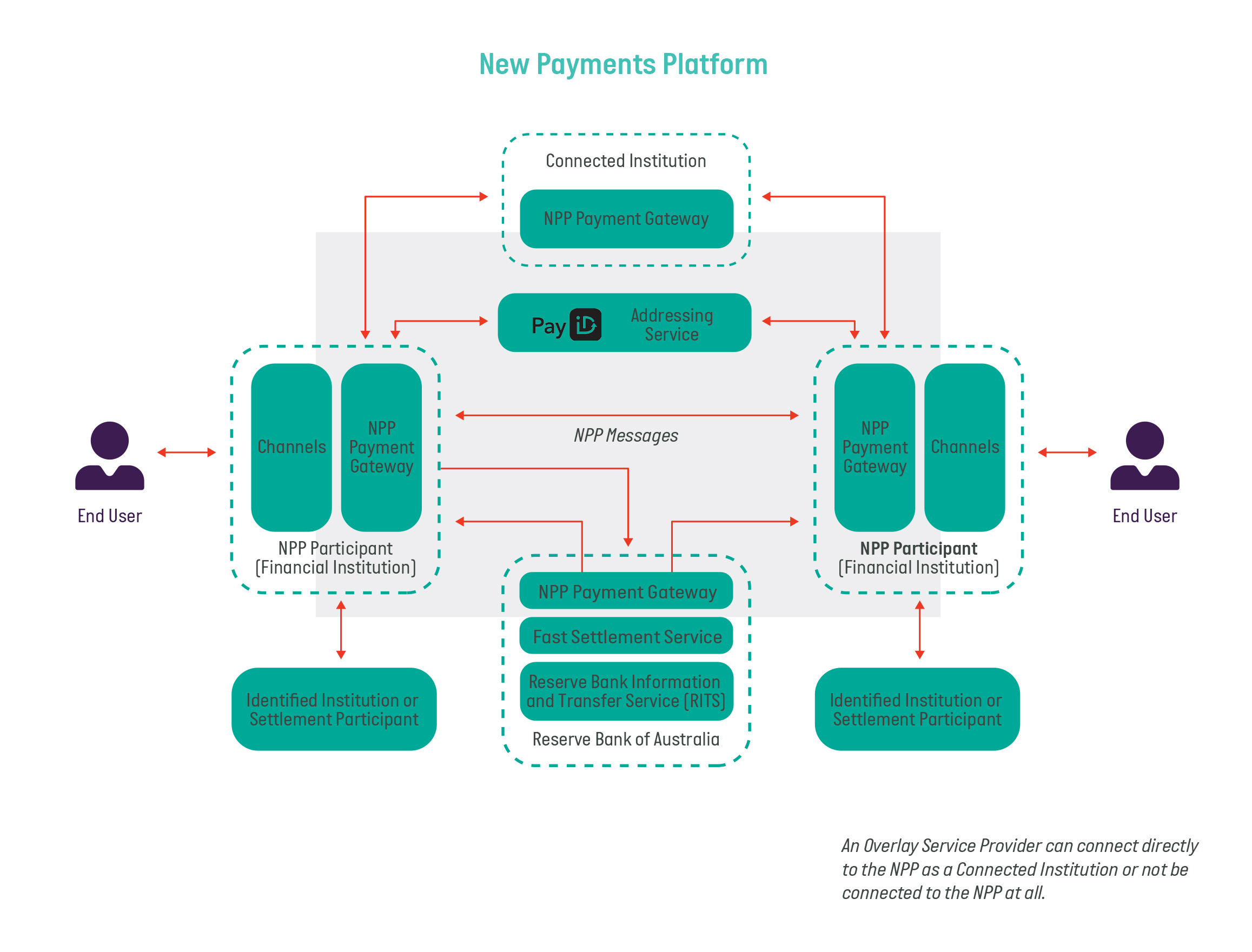

The New Payments Platform (NPP) is a system designed to enable real-time payments between financial institutions in Australia. The diagram illustrates the interactions between different participants within the NPP ecosystem.

At the center of the platform, NPP Messages are exchanged to facilitate transactions between NPP Participants (such as financial institutions) and Connected Institutions. Each NPP Participant has an NPP Payment Gateway and various Channels to interact with End Users (e.g., customers). End Users can initiate payments through these channels, which are then processed by the participant's gateway and sent across the NPP. The NPP is also supported by Fast Settlement Service components within the Reserve Bank of Australia (RBA), including the Reserve Bank Information and Transfer System (RITS), ensuring the efficient settlement of transactions between participating institutions.

Overall, the NPP structure enables seamless, instant transactions, where each participant, including overlay service providers, can connect directly or indirectly to facilitate payments across the network.

Real-time clearing and settlement ensure funds are immediately available, supporting fast and secure transfers.

2. Alias-Based Addressing and Directory Resolution

A2A systems simplify payment processes with alias-based addressing, allowing users to link their accounts to unique identifiers rather than traditional bank account numbers.

- Alias Directory Services: Real-time A2A networks typically include a central directory that links identifiers like mobile numbers, emails, or unique IDs to users’ bank accounts.

Australia PayID: Australia’s NPP introduced PayID, where users link their accounts to identifiers like mobile numbers or emails. This reduces errors and simplifies transfers. In addition to facilitating real-time payments, the NPP includes an Addressing Service, which allows transactions to be directed using identifiers like PayID rather than traditional bank details.

3. API-Driven Real-Time Payment Integration

Application Programming Interfaces (APIs) are a critical component of real-time A2A payments, enabling third-party platforms to connect seamlessly to the payment network.

-

Transaction Initiation via API: APIs allow fintechs, businesses, and other authorised entities to initiate transactions directly through the A2A system, with real-time status updates and error handling.

-

Standardised API Messaging: Many real-time payment networks, including Australia’s NPP, adopt the ISO 20022 standard for API messaging. This standardisation supports data consistency and interoperability with other payment networks.

4. Advanced Security Protocols and User Authentication

Security is a top priority in real-time A2A systems, given the immediate nature of transactions. These systems employ advanced security measures to protect user data and prevent fraud.

-

End-to-End Encryption: Data is encrypted throughout the transaction lifecycle, using standards like TLS (Transport Layer Security).

-

Multi-Factor Authentication (MFA): Many systems, including the NPP, require MFA, like OTPs or biometrics, for authentication.

-

Tokenisation: Sensitive data, like account details, is replaced with unique tokens to ensure data protection throughout the transaction.

Real-time fraud detection and tokenisation keep user information safe, making real-time A2A payments highly secure.

5. High-Availability Infrastructure for Continuous Operation

Real-time A2A systems require robust, high-availability infrastructure to guarantee 24/7 operation and handle fluctuating transaction volumes effectively.

-

Load Balancing: Load balancers distribute incoming requests across multiple servers, preventing bottlenecks and ensuring consistent transaction processing.

-

Redundant Systems and Backup Data Centres: To minimise downtime, systems implement redundancy through backup servers and distributed data centres.

-

Scalability: Many real-time systems, including Australia’s NPP, are built on scalable, cloud-based architectures that adjust to transaction volume demands.

6. Real-Time Data Reconciliation and Compliance Reporting

Continuous reconciliation and compliance monitoring are crucial to maintaining accurate records and meeting regulatory requirements in real-time A2A systems.

-

Instant Data Synchronisation: Transaction data is synchronised in real time across all participants, enabling immediate error resolution if discrepancies are detected.

-

Automated Reconciliation: Systems like the NPP employ automated reconciliation tools that match transactions across institutions, ensuring real-time data accuracy.

-

AML/CTF Compliance: Real-time payment systems integrate AML (Anti-Money Laundering) and CTF (Counter-Terrorism Financing) checks to detect suspicious activity and generate regulatory reports automatically.

Real-Time Payment Innovations in India and Southeast Asia

While Australia’s NPP leads in real-time A2A payments, other regions have also made significant strides, showcasing adaptations suited to local needs.

India: Unified Payments Interface (UPI)

India’s Unified Payments Interface (UPI) enables instant transfers using virtual payment addresses (VPAs) and QR codes.

-

Alias-Based Addressing: UPI’s virtual payment addresses (VPAs) simplify transfers, allowing users to link a unique identifier to their bank account.

-

API-Driven Open Architecture: UPI’s open API model enables seamless integration with third-party applications, supporting diverse payment use cases.

-

Advanced Security: UPI includes two-factor authentication and end-to-end encryption, ensuring transaction integrity.

Southeast Asia: Regional Real-Time Payment Systems

Southeast Asia has implemented several real-time A2A systems, including:

-

PromptPay (Thailand): Supports alias-based payments via mobile numbers or national IDs.

-

FAST (Singapore): Enables bank-to-bank transfers and QR code payments, supporting both traditional accounts and mobile wallets.

-

DuitNow (Malaysia): Allows real-time transfers using phone numbers or national IDs, with plans for cross-border interoperability within ASEAN countries.

Technical Benefits of Real-Time A2A Payments

The technical design of real-time A2A systems provides several advantages over traditional methods:

-

Lower Transaction Costs: Real-time A2A payments reduce transaction fees, offering a cost-effective option for consumers and businesses.

-

Instant Cash Flow ⚡: Businesses benefit from immediate settlement, allowing access to funds as soon as a payment is made.

-

High Availability and Resilience: Designed for 24/7 operation, real-time systems ensure accessibility and scalability, handling high transaction volumes reliably.