Real-Time A2A PayIn Service

Hello Clever’s Real-Time PayIn Service provides businesses with fast, secure, and scalable account-to-account payment options, ideal for seamless transactions across Australia and the APAC region. Designed to support instant access to funds and efficient reconciliation, our real-time PayIn services offer flexible integration options to meet the demands of modern businesses.

Real-Time PayIn Options in Australia

In Australia, Hello Clever supports multiple real-time payment options, allowing businesses to accept account-to-account payments with ease:

1. PayID

PayID enables instant account-to-account payments using an identifier (such as an email address or phone number) linked to a bank account. This method simplifies the payment process for customers while enhancing the speed and security of transactions. Hello Clever offers two types of PayID to meet different business needs:

-

One-Time PayID (Transactional): This single-use PayID is generated for individual transactions and can be used through both the Payment Gateway and API integrations. Ideal for businesses requiring secure, transaction-specific identifiers, ensuring security and precise fund tracking.

-

Static PayID (Reusable): A persistent PayID that can be reused for multiple transactions, available through API integration only. This is particularly useful for businesses with frequent or recurring payments, offering a consistent payment destination for customers.

Technical Features

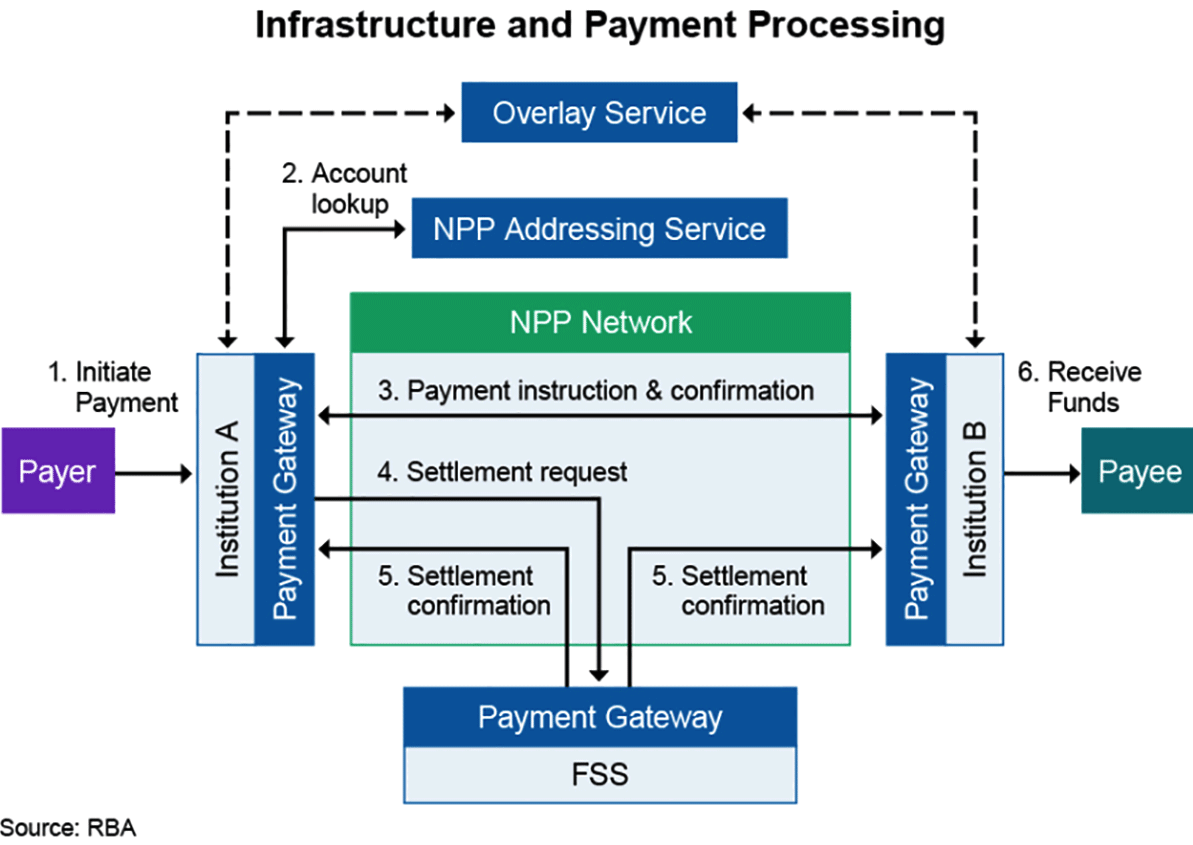

- Instant Transfer Protocol: Built on Australia’s New Payments Platform (NPP), allowing for real-time settlement between Australian financial institutions.

- Custom Domain PayIDs: Hello Clever supports branded PayIDs (e.g., [email protected]) in approved cases, helping businesses reinforce brand identity while ensuring payments are memorable and customer-friendly.

💡 Enhance your brand with a Custom Domain PayID! By using a branded PayID (e.g., [email protected]), businesses not only make transactions easier to remember for customers but also strengthen brand recognition and trust. Custom domains help reassure customers that payments are going directly to the official business account.

2. BSB/Account PayIn

Hello Clever supports traditional bank transfers via BSB and Account numbers for customers who prefer conventional methods. For added convenience, Hello Clever can issue named virtual accounts to help businesses manage individual customer payments.

Technical Features

- Real-Time and Direct Entry (DE) Transfers: Real-time payments are facilitated via NPP for instant transfers, while DE payments are used as a fallback for slower transfers.

- Automatic Reconciliation: Payment descriptions are automatically matched with incoming funds, reducing manual reconciliation and improving accuracy.

3. PayTo (Available Upon Request)

PayTo is an advanced solution under the NPP, providing a digital alternative to traditional direct debits. PayTo agreements allow customers to authorise recurring or one-off payments directly from their bank accounts, making it highly suitable for businesses with subscription or recurring payment models.

Technical Features

- Direct Authorisation and Real-Time Processing: Built directly into the NPP, PayTo authorisations enable quick, real-time processing without manual approvals.

- Automated Compliance: PayTo adheres to Australia’s regulatory standards, providing businesses with compliance-ready recurring payment options.

Note: PayTo agreements are particularly effective for businesses needing frequent, secure recurring payments, such as utilities, streaming services, or subscription models.

Real-Time PayIn Options in APAC

In the APAC region, Hello Clever’s single real-time payment (RTP) connection integrates with local banking systems to support rapid, account-to-account payments across multiple countries.

Real-Time Payment (RTP) Integration

- API Access: Businesses can connect directly to Hello Clever’s RTP infrastructure through our API, enabling them to initiate and track cross-border transactions seamlessly.

- Rail-Specific Adjustments: Our system aligns with regional real-time payment rail specifications, ensuring compliance with local requirements in each country.

Float Account Management for Multi-Currencies 💱

All PayIns made through Hello Clever are credited to a float account dedicated to each currency, enabling businesses to manage funds centrally across different markets.

Key Technical Aspects:

- Multi-Currency Float Accounts: Each currency operates as a distinct float account, improving fund management for businesses transacting in both AUD, SGD, and other currencies.

- On-Demand FX Conversion: Businesses can convert funds between float accounts as required, with real-time exchange rates, supporting international operations and cross-border payouts.

Integration Options

Hello Clever’s Real-Time PayIn services are available through both Payment Gateway and API integrations, providing flexible integration options:

- Payment Gateway: A straightforward, secure interface for accepting payments on websites or apps, ideal for businesses looking for a quick setup.

- API Integration: Supports more advanced payment flows, enabling businesses to control the customer experience and automate payment processing.